Post

- Jessie, LAI

- April 15, 2024

- 3:02 pm

- Jessie, LAI

A Guide to Hong Kong Top Talent Pass Scheme (Real-case Scenario)

Official Data

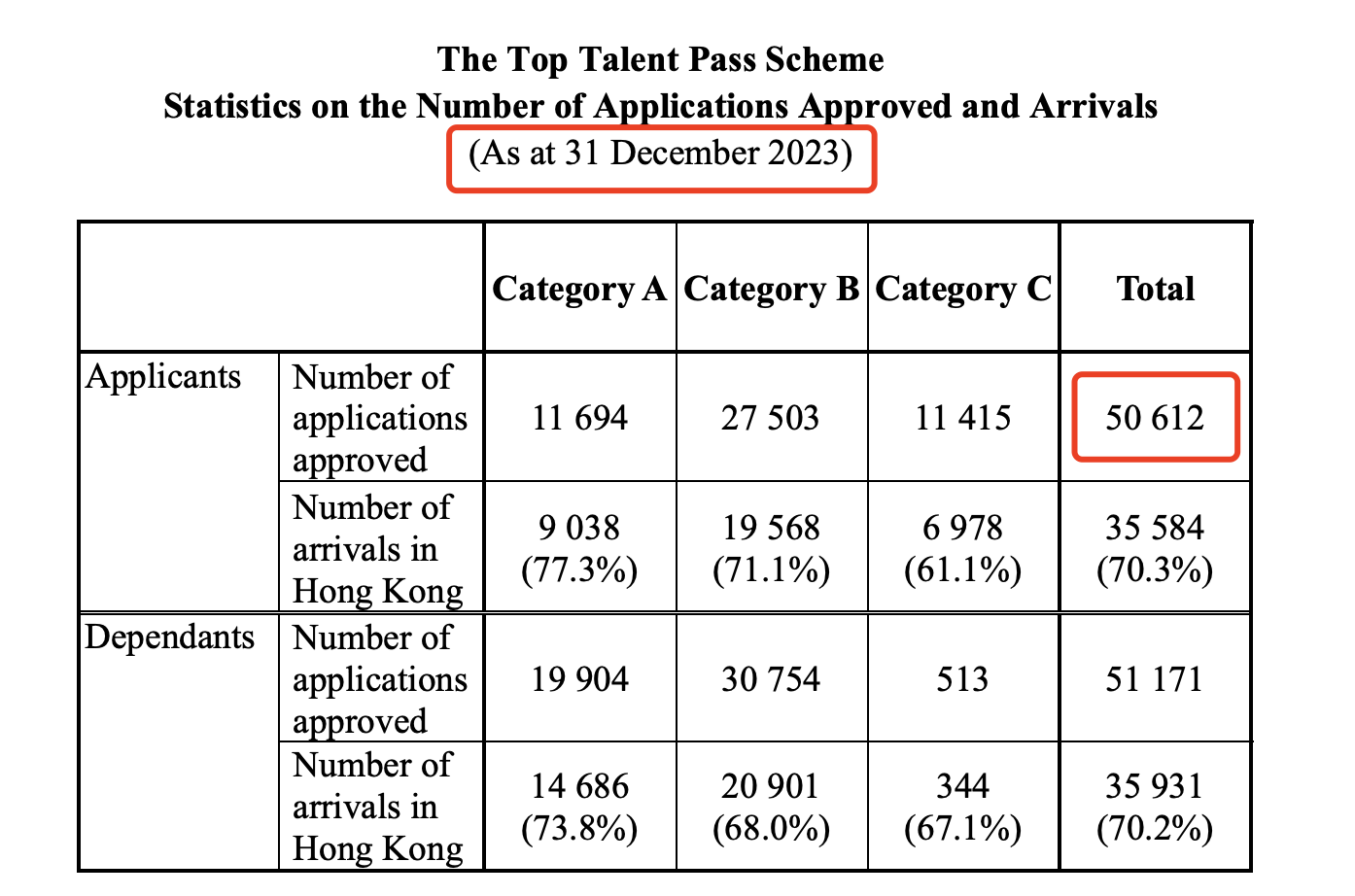

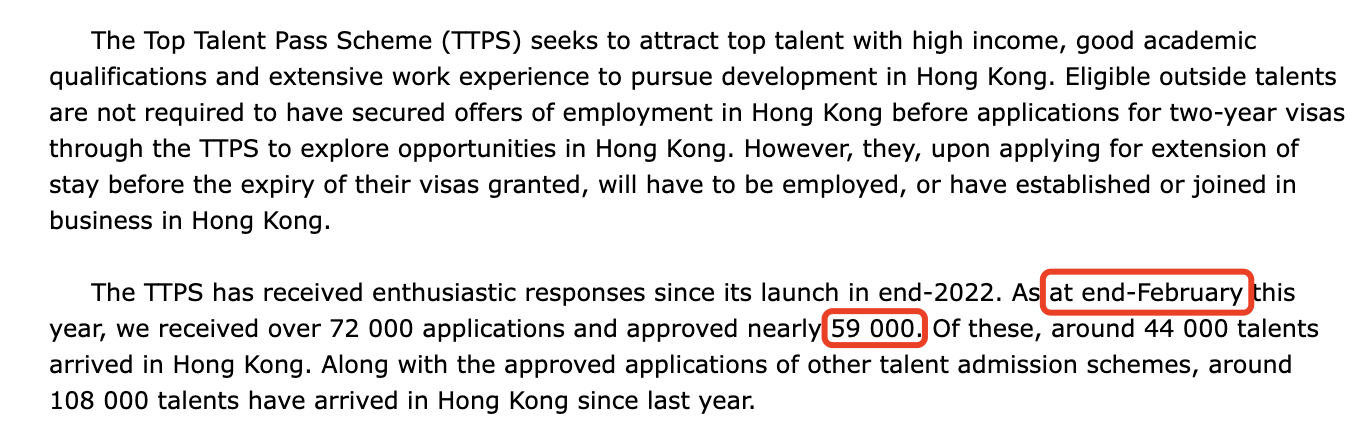

The Hong Kong Top Talent Pass Scheme has undoubtedly been a rising star in 2023 and 2024, as indicated by official data: As of December 31, 2023, the total number of approvals under the scheme was 50,612, with the B and C categories combined totaling nearly 40,000, the majority share. However, two months later, by the end of February 2024, the number of approvals had increased to 59,000, signaling an increase of nearly 8,500 approvals in just two months. This remarkable surge in approvals suggests significant demand and also implies an inevitable tightening of policies.

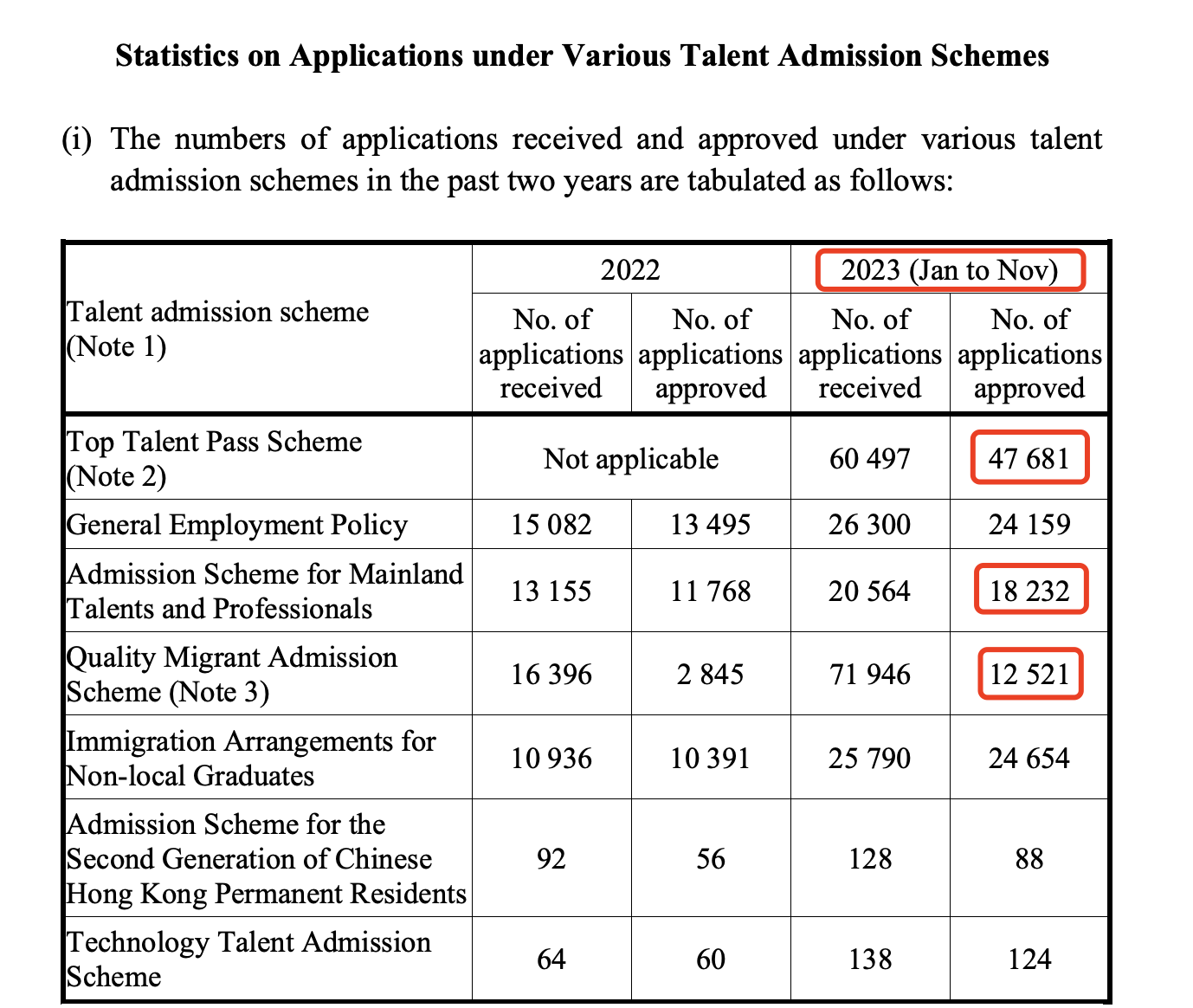

What does this figure of 59,000 approvals represent? Let’s provide a comparative example: The data for approvals from January to November 2023 are as follows: the Top Talent Pass Scheme (TTPS) had 47,681 approvals, the Admission Scheme for Mainland Talents and Professionals (ASMTP) had 18,232 approvals, and the Quality Migrant Admission Scheme (QMAS) had 12,521 approvals. As a newcomer, the approval volume of TTPS was 2.6 times that of ASMTP and 3.8 times that of QMAS.

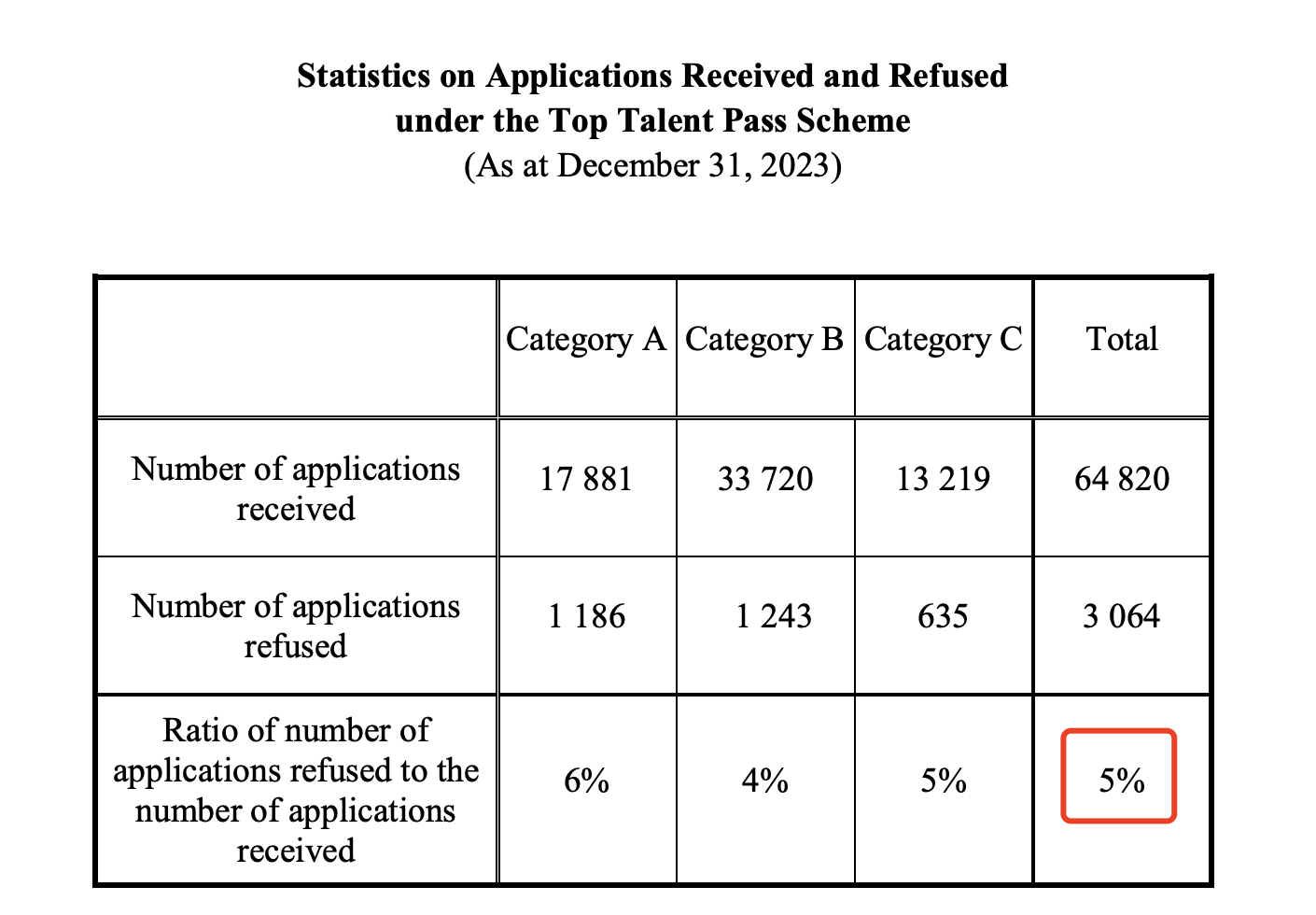

On the other hand, as of the end of December 2023, the proportion of rejections in TTPS cases was only 5%, with a high success rate of 95%, surpassing all other programs in Hong Kong.

However, as mentioned earlier, behind the large number of approvals, the Hong Kong government has already reached its anticipated intake of individuals, leading to stricter scrutiny. Due to lack of experience, many immigration agencies in the market have a superficial understanding of the application requirements for Category A of the Top Talent Pass Scheme, resulting in applicants unnecessarily losing significant amounts of taxes. Globevisa will analyze typical successful cases, combined with recent common supplementary materials, to dissect how the required taxable income of HKD 2.5 million by the Immigration Department is calculated. Before fully understanding these details, it is crucial not to distribute dividends blindly.

Does the shareholder have to distribute dividends?

Globevisa client’s case study:

Mr. LI submitted his application in December 2023. The assessable profits of his company for the fourth quarter of 2022 and the first three quarters of 2023 amounted to over 6 million Hong Kong dollars. In January 2024, he received a request for additional documents, including the annual corporate income tax return and audit report. Since it was not yet the local annual tax settlement time in January, the Globevisa TTPS team analyzed the stable profit growth of the company and recommended that the client first submit the income tax return for the fourth quarter of 2023. By completing the declarations for all four quarters of 2023, the application was successfully approved.

Approval Letter for Mr. Li’s Top Talent Pass Application from the Immigration Department of Hong Kong

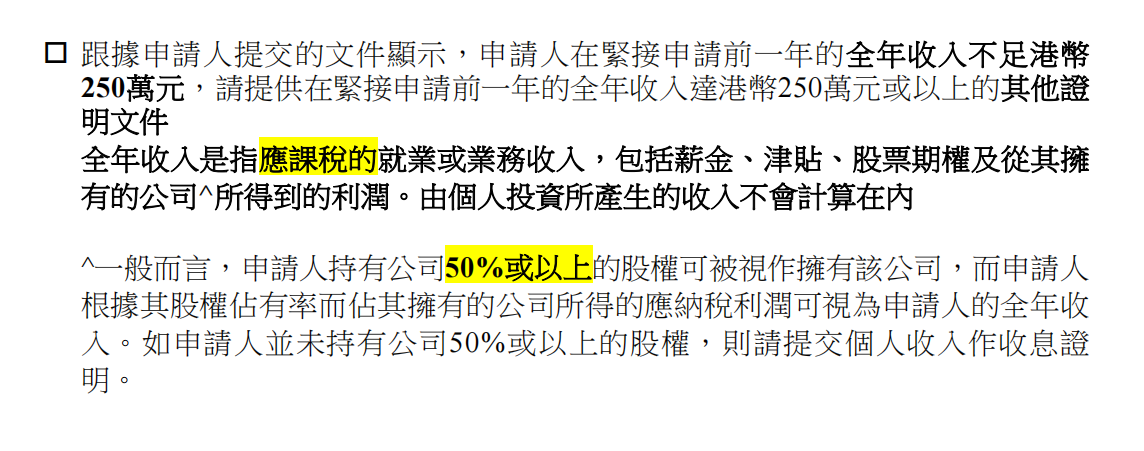

Applicants of this type of application do not need to distribute dividends at all; They can directly submit the company’s income tax returns. The key point for such applications is the shareholding percentage, where the applicant’s shareholding percentage must be greater than or equal to 50%. Only then can the assessable profits of the company be calculated into the applicant’s income based on the shareholding percentage. The correspondence issued by the Immigration Department also clearly emphasizes this point.

Translation of the text as requested by the Immigration Department.

“According to the documents submitted by the applicant, the applicant’s total annual income for the year immediately preceding the application is less than HKD 2.5 million. Please provide additional documentary evidence of total annual income of HKD 2.5 million or above for the year immediately preceding the application.

Total annual income refers to taxable employment or business income, including salaries, allowances, stock options, and profits derived from the ownership of shares in a company. Income generated from personal investments will not be included.

Generally, an applicant holding 50% or more of the shares in a company can be considered as owning that company. The taxable profits obtained by the applicant based on their shareholding in the company can be considered as the applicant’s total annual income. If the applicant does not hold 50% or more of the shares in the company, please submit personal income as proof of income.”

Can temporary share transfer be done?

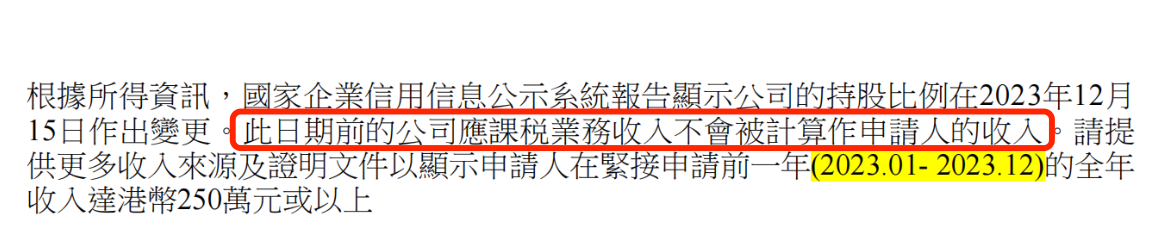

During the initial period of policy advantages in this program, there were indeed several successful cases of temporary share transfer. However, in recent times, the Immigration Department has tightened its scrutiny and stated that the profits of the company before temporary share transfer cannot be calculated. Only the income after the share transfer can be considered, which often results in insufficient income for the applicant. Temporary share transfer carries significant risks, as the applicant must rely on the increased profits of the company after the share transfer to meet the application requirements later on.

Can temporary conversion of shares be done?

During the policy dividend period at the beginning of this project, there were indeed several successful cases of temporary share conversion. However, recently, the immigration department has tightened its scrutiny and stated that the profits of the enterprise before temporary conversion cannot be counted, only the income after conversion can be calculated. This often results in the applicant’s income being insufficient. Temporary share conversion carries a greater risk, and in the later stages, it is necessary to meet the application conditions by achieving high profits after the conversion.

Translation:

“According to income information, the report from the National Enterprise Credit Information Publicity System shows changes in the company’s shareholding ratio on December 15, 2023. Income received by the company before this date will not be calculated as the applicant’s income for taxable business purposes. Please provide additional sources of income and supporting documents to demonstrate that the applicant’s annual income for the year immediately preceding the application (January 2023 to December 2023) amounts to HK$2.5 million or more.”

Can sudden profit growth be accepted?

All cases in Hong Kong are manually reviewed, and the directors at the immigration department gradually refine the review standards as their experience with cases grows. In the initial stages, it may be sufficient for the data amounts in key documents to meet the requirements. However, currently, the immigration department also needs to examine the overall rationality of profit composition. For example, the applicant’s company obtained significant profits in the current month, and we request relevant business documents such as company operating invoices, purchase contracts, and bank statements of business income for the past six months.

Can a company with only one person but sufficient profit be accepted?

It’s a challenging scenario, but Globevisa has achieved success in such cases. Take Ms. WANG for instance; Her income breakdown reveals that 100% of her company’s 2023 profits amounted to HK$2.55 million. Initially, she submitted the company’s financial statements and tax documents for quarters 1 to 4 of 2023. During the initial submission, she was asked to provide the annual financial statements for 2023 as supplementary material. However, during the second round of submission, the director raised concerns about how a company with only one employee could generate such significant profits. Leveraging the business documents provided by Ms. WANG and their wealth of experience in documentation, the Globevisa team effectively explained to the director the sources of the company’s income and its operational model. The supplementary documents were submitted on April 3rd, and approval was granted smoothly on April 8th.

Recent Posts

Comments